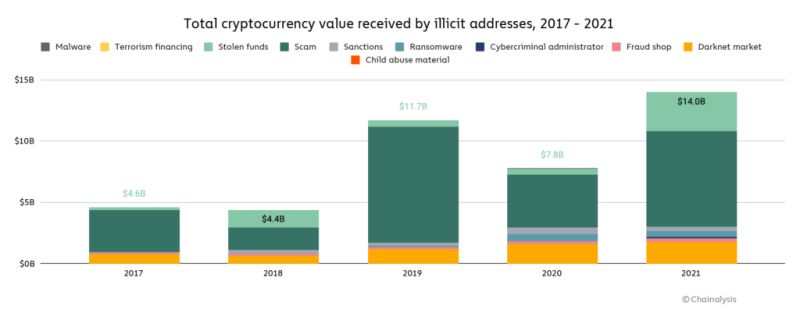

Cryptocurrency usage is growing faster than ever before with the growth of legitimate cryptocurrency usage far outpacing the growth of criminal usage. Transactions involving illicit addresses represented just 0.15% of the total cryptocurrency transaction volume in 2021. Despite that, considering the significant total volume of cryptocurrency related transactions, approximately $14 billion was estimated to have been received by illicit addresses in 2021, up from $7.8 billion in 2020, according to a report by blockchain data company Chainalysis.

While the majority of cryptocurrency transactions are for legal activities, federal agencies recognize the significance of the volume of these transactions and have stepped up their investigation and prosecution of companies and individuals believed to be engaged in cryptocurrency crimes.

More recently, two Estonian citizens were arrested in Tallinn, Estonia, on an 18 count indictment for their alleged involvement in a $575 million cryptocurrency fraud and money laundering conspiracy, according to a press release by the US Department of Justice on November 21, 2022.

Sergei Potapenko and Ivan Turõgin allegedly defrauded hundreds of thousands of victims through a multi-faceted scheme. They induced victims to enter into fraudulent equipment rental contracts with the defendants’ cryptocurrency mining service called HashFlare, according to court documents. Victims paid more than $575 million to Potapenko and Turõgin’s companies. Potapenko and Turõgin then used shell companies to launder the fraudulent proceeds and to purchase real estate and luxury cars, the announcement said.

Noting the fast pace at which cryptocurrency usage is gaining popularity, the most significant consideration is not solely the percentage of transactions corresponding to illicit addresses each year but what they might tell us about the potential increase in actual amounts. Authorities are beginning to consider what the scale of the problem might be in the future with more regulatory frameworks to be considered in various jurisdictions.

In our experience, considering its vast accessibility to the public, crypto-related fraud affects a wide range of industries and parties from multinational corporations to private investors, banks, and others. Despite its notoriously hard-to-trace nature, #GlobalSource has risen to the challenge and has a proven track record in assisting clients dealing with cryptocurrency-related fraud. Our global reach, coupled with our staff’s expertise, allows us to provide in-depth analysis, consulting, advisory, and ultimately solutions to our clients in uncovering mechanisms utilized in complex cryptocurrency-related frauds.